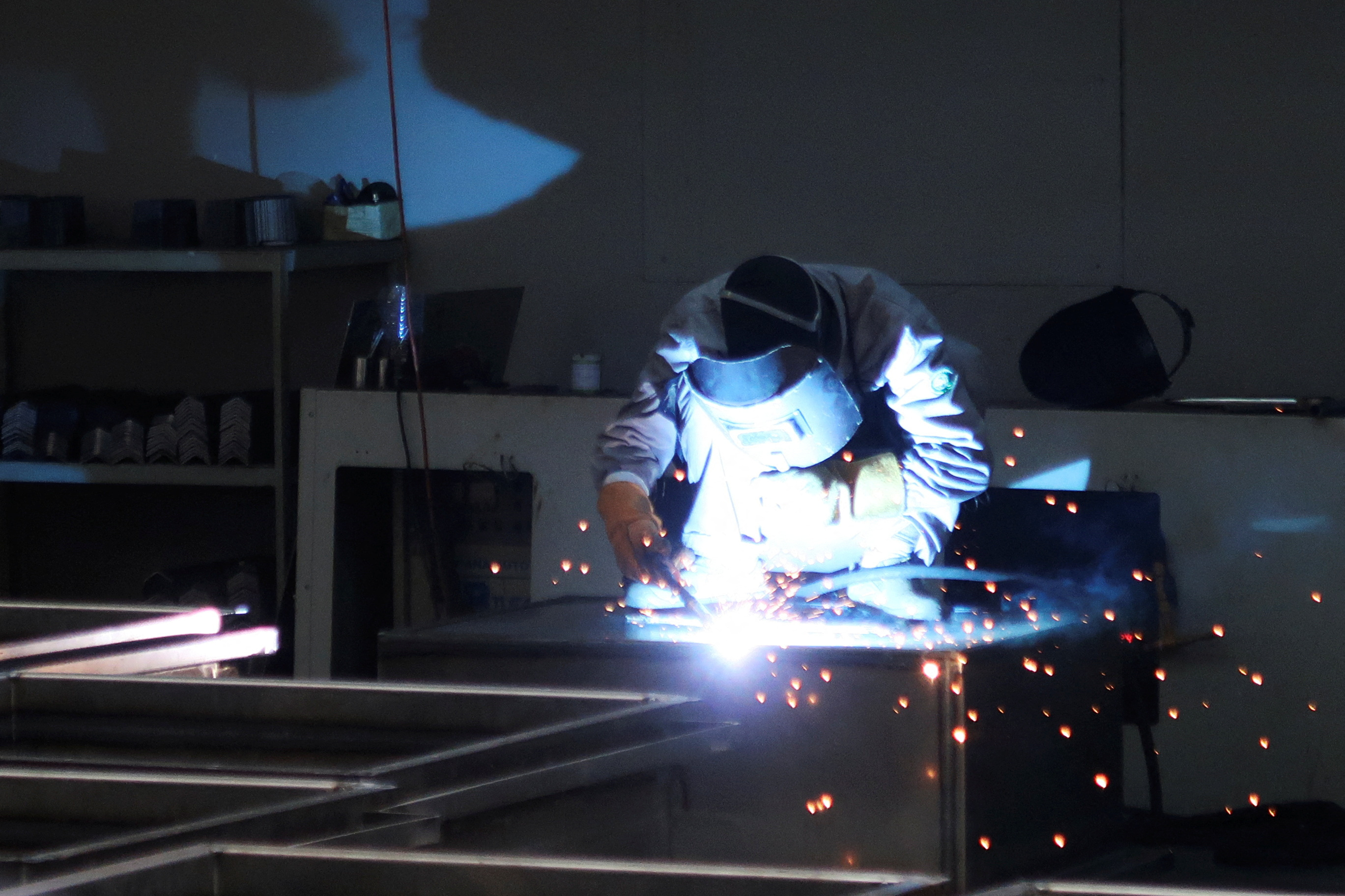

An employee works on a production line at the Jingjin filter press factory in Dezhou, China’s Shandong province, on August 25, 2022. REUTERS/Siyi Liu/File Photo Get license rights

BEIJING, Sept 30 (Reuters) – China’s factory activity expanded in September for the first time in six months, an official survey showed on Saturday.

The purchasing managers’ index (PMI), based on a survey of major manufacturers, rose to 50.2 from 49.7 in September, according to the Office for National Statistics, above the 50-point level that defines a contraction in activity from an expansion. Reading beat the forecast by 50.0.

The PMI, the first official figure for September, added to signs of stability in the economy, which had slumped after an initial burst of momentum earlier in the year when China’s ultra-restrictive COVID-19 policies were lifted.

Initial signs of improvement emerged in August, with factory production and retail sales growth accelerating, while declines in exports and imports eased and deflationary pressures eased. Industrial firms’ profits rose 17.2% in August, reversing July’s 6.7% decline.

“Manufacturing PMI and good industrial profit figures suggest the economy is gradually bottoming out,” said Zhou Hao, chief economist at Guotai Junan International.

China’s non-manufacturing PMI, which includes sub-indices for service sector activity and construction, rose to 51.7, versus 51.0 in August.

Composite PMI, including manufacturing and non-manufacturing activity, rose to 52.0 from 51.3 in September.

Near-term data on economists’ radar includes consumer spending for the longest public holiday of the year. The “Golden Week” began with the Mid-Autumn Festival on Friday, followed by the National Day holiday until October 6.

Passenger travel by rail hit 20 million trips on Friday, a single-day record, state media reported Saturday, marking the start of what officials predicted would be “the most popular golden week in history.”

Property risks

More stable economic indicators will be welcomed by policymakers as the property sector continues to grapple with the credit crunch that has rocked global markets. Authorities have announced a series of measures to boost the property market, including lowering mortgage rates, but the sector is far from out of the woods.

New home prices fell the fastest in 10 months in August. Property investment fell for the 18th consecutive month.

China Evergrande Group ( 3333.HK ), the world’s most indebted property developer with more than 300 billion in loans, said on Thursday its founder was being investigated for suspected “illegal crimes”.

The Asian Development Bank last week cut its 2023 economic growth forecast for China to 4.9% from a July forecast of 5.0%.

Analysts say additional policy support will be needed to ensure China’s economy reaches the government’s growth target of around 5% this year.

“China’s economy has stabilized somewhat due to the easing of asset policies,” said Shiwei Zhang, chief economist at Pinpoint Asset Management.

“The key issue going forward is whether fiscal policy will become more supportive. I think, but timing-wise, the change in fiscal policy stance may happen next year instead of this year.”

Reporting by Ryan Wu, Tina Qiao and Joe Cash; Editing by Michael Perry and William Mallard

Our Standards: Thomson Reuters Trust Principles.